Memo From Frank

As 2013 begins, the “fiscal cliff” has demonstrated, once again, the perilous position we are all in economically. There has never been a more important time to develop multiple streams of income, to offset the high level of risk that we all face financially. In many ways, each billboard is like a different income stream. A portfolio of billboards is like having a portfolio of income-producing assets – each one paying a certain set of your household bills. On a dollar for dollar return – or return on your time—you cannot find a more profitable way to invest your time and money. If you don’t have any billboards yet, then 2013 is a good year to begin to create your own portfolio of assets and income streams.

When Is A Billboard Ground Lease Too Short?

When buying or building a billboard, an issue that always comes up is the ground lease length. Obviously – from a billboard company perspective – longer is always better. But many property owners balk at the idea of tying up their property for decades, and demand a shorter ground lease. So a constant issue that all sign owners must confront is how short is too short. There are many issues at play in deciding the answer.

What is the size of the investment, and the length of time to pay it off?

This is always the best starting spot. If it will take you nine years to pay off the billboard you are building or buying, then a five year lease is not going to work. Even if you start to sell yourself on the idea that it would be O.K., your bank will shoot you down. Conversely, if you can pay the sign off in five years, a five year lease might be O.K. (but not advisable), and if it will take you two years to pay off the investment, then a five year lease is fine. As a general rule, you should never take on a lease that is shorter than your note. That’s a pretty easy guideline, but you’d be surprised how many billboard owners forget about it.

What is the likelihood for development or re-sale?

Normally, the only time a sign comes down is when a property gets developed. Until then, the sign is seen as a valuable income tool from the landowner. But development throws a big wrench into that hypothesis, as the value of that billboard’s lease payment is the tail wagging the dog on the value of the development of the entire tract of real estate. Short leases – or even short-notice cancellation provisions – on a property that is prime for development is the kiss of death. When your sign is on farmland in the middle of nowhere, or land that can’t be developed due to floodplain, etc., then the odds of the lease not renewing at the end of the term are very small. But many landowners, when they feel like a sale and development are imminent, may allow the sign to come down just to pave the way for the ultimate sale of the property. When development risk is high, a short term lease is suicide. When the development risk is low, a shorter term lease may be acceptable.

How likely is the sign location to remain legal for a future re-build?

The odds of a sign coming down decrease enormously – almost to zero – when the sign become legal, non-conforming (grandfathered). Until that time, upon lease expiration, you are likely to go to a bidding war with the other billboard companies. But when a sign becomes grandfathered, you are the only game in town, and the landowner must basically choose between you or no billboard at all. If you are buying a sign, and the sign is already grandfathered, then a shorter lease may work because you can simply get extensions as time goes on. If the location is not grandfathered, however, you may lose the sign to a higher bidder the day the lease ends, and the length of lease, on the front end, is all that you will ever have.

When in doubt, hedge your bet

The human brain is extremely complicated and can store more data, and make better decisions, than any computer. If your gut instinct is telling you that the lease is too short, then go with that feeling and either sell the location to another sign company, or don’t sign the lease. I have only gone against my gut instinct one time on a lease, and it had catastrophic consequences. It was a very expensive set of signs that cost $100,000 each. The lease was a 24-hour lease through the railroad. Everybody told me – including the railroad – that the leases would never be cancelled. Nevertheless, several months after closing, that’s exactly what happened. I should have flipped the signs to a larger company, or not bought them. Instead, I spent years trying to make back the money I lost.

There’s no simple formula

There’s no simple answer to how short is too short on a billboard lease. There’s a ton of different bits of data that go into that decision. But, like the old adage, “you can never be too rich or too thin” – they should add that a billboard lease can never be “too long”. So do the best you can when the landowner balks at a long lease, but remember that there’s no right or wrong answer.

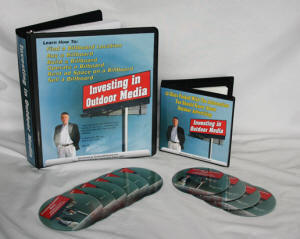

Billboard Home Study Course

![]() How to Find a Billboard Location

How to Find a Billboard Location

![]() How to Buy a Billboard

How to Buy a Billboard

![]() How to Build a Billboard

How to Build a Billboard

![]() How to Operate a Billboard

How to Operate a Billboard

![]() How to Rent Ad Space on a Billboard

How to Rent Ad Space on a Billboard

![]() How to Sell a Billboard

How to Sell a Billboard

Get Your Copy Now!

A Billboard Story

I once tried to get a billboard ground lease with an individual that would tell me that my offers were too low, and that they “spend more money than that on lunch”. They made out like money was no object, and tried to belittle me. So I was extremely happy to see a notice that they had gone bankrupt in the paper. I have found, over time, that people who pretend like money is no object, have no money. People who are really wealthy watch every penny, and will bend over backwards to wring that last $100 out of their land. So don’t ever let anyone make you feel petty with your billboard proposal.

The Market Report

Prices Are Delayed By At Least 15 Minutes