Billboard Lending ABC’s

So you’ve found a legal location to build a billboard, signed up the ground lease, and are ready to start planning construction. But where do you get the money from to build it? This is a problem that every billboard owner has faced, whether it’s Clear Channel or somebody’s first sign. So here’s a rundown of the options out there today:

• Traditional bank loan. Basically, you borrow money from your local bank, at an interest rate of probably around 8% to 10% and a five year balloon (although sometimes you can get a 10 year term). Bank lending is scary at first, because you don’t have a track record of success, and the bank will plow through your credit history and ask you questions like your personal cash flow and financial statement. But many people start out with their good old-fashioned hometown bank. I built the first pile of my billboards using just such a bank – the now defunct Turtle Creek National Bank in Dallas. Positives: they want to make loans, they are fair and reasonable, they are governed by banking law on their behavior, you can build quite a few signs with them over time, as they have loan limits of around $500,000. Negatives: they are scary to work with early on, the personnel can change over time, and banks can fail sometimes.

• Private lenders. These folks are often the lender of last resort as they charge an extremely high interest rate (12%+), and have sometimes ridiculous terms (like you have to pledge every asset you have in the world against one small loan). In addition, they are not governed by banking rules of conduct, and they can be downright scary to work with, particularly if you have a problem. Positives: they will make loans, and they will often make loans when banks won’t. Negatives: the interest rates are very high, the terms often impossible to meet, and it’s often like borrowing from the mob.

• Friends and family (especially self-directed IRAs). Most people go about these type of loans incorrectly. If you are trying to borrow $30,000, you do not want to hit up your Aunt Tootsie for $30,000. Instead, you’d want to find five family members or friends who would be willing to invest $6,000 each. When you try to borrow a large sum from one person, they freak out because of the downside if something goes wrong. However, smaller sums are still within their comfort zone, and won’t bankrupt them if your concept fails. Additionally, the fact that others are willing to make the same loan gives them greater confidence that it’s a good idea. To take that concept to the next level, consider the wonders of self-directed IRAs. If you have a friend or family member with an IRA, they can convert that IRA to a self-directed IRA (also known as SDIRA) for as little as $500, and then invest in many different things that regular IRA’s can’t – such as billboards (but please ask a professional to confirm this with your particular case). With IRA’s paying such low amounts right now – as little as ½ of 1% -- they are very interested in earning a higher return. Plus, since it’s an IRA, they can’t use or need the principal for years (until they reach retirement age), so there’s no immediate pressure to pay them back. Positives: easy to approach, you can offer an interest rate up to 10 times higher than what they’re getting now, virtually no credit screening, and the options of SDIRA patience. Negatives: if you screw up, they’re your friends and family, and you’ll feel terrible about it.

• Seller financing. More prevalent than you think, particularly in cases of signs that seem impossible to rent and difficult to sell. Many a turnaround billboard or group of billboards have been purchased using seller carry. Basically, you make a down-payment, and the seller carries the financing for a specific period of time – often to maturity. There’s normally no credit check, and you can sometimes even get low interest amounts (based on how undesirable the billboard seems). Positives: easy to qualify for (no credit check), often low interest rate, and the seller really carries the risk of whether or not the deal works in the end. Negatives: hard to find, and these type of billboard turn-around projects can be really tricky.

Financing billboards is like riding a bike – once you’ve done it, it’s no big deal going forward. But you have to start somewhere. Hopefully, this has given you some ideas on the options out there. So explore the options, and decide on the one that’s best for you. Don’t let financing be a roadblock.

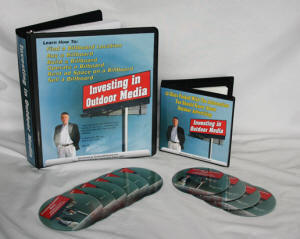

Billboard Home Study Course

![]() How to Find a Billboard Location

How to Find a Billboard Location

![]() How to Buy a Billboard

How to Buy a Billboard

![]() How to Build a Billboard

How to Build a Billboard

![]() How to Operate a Billboard

How to Operate a Billboard

![]() How to Rent Ad Space on a Billboard

How to Rent Ad Space on a Billboard

![]() How to Sell a Billboard

How to Sell a Billboard

Get Your Copy Now!

Memo From Frank

I get calls from people all the time that are looking at billboards to buy, but think there must be something wrong with their analytical skills because the numbers don’t make any sense. The problem is not with the buyer’s analytical skills, it’s with the seller’s pricing formula. Basically, there are some sellers out there that want 10 times more than things are worth. For example, somebody was trying to sell a billboard recently that made about $20,000 per year, for $400,000 . That’s a 5% cap rate – basically, you would never be able to pay the sign off, as you’d be lucky to make just the interest payment per month. Some buyers think that this implies that there is some type of trick to making money with a sign like that – that no seller would be so stupid as to ask such a crazy price. But they do. Some sellers are opportunistic. So the next time that someone is asking a ridiculous price for their billboard, don’t lose faith in yourself, lose faith in their ability to be reasonable. You can always buy that sign later – from the bank after they foreclose on it.

A Billboard Tale

Back when vinyls first came out, people would buy the old, used vinyls and re-sell them as murals for kid’s rooms. For example, if you had a billboard for Budweiser with a picture of the NASCAR race car on it, you could sell it when you took it down to trash it, for $100 to somebody who would then turn around and sell the vinyl for $300 to someone who wanted to cut it out and stick it to their bedroom wall as a mural. Of course, today you can buy the exact same thing in much greater pixel resolution and without the dirt and stains of an old vinyl (and smell). But when vinyl first came out, it was so revolutionary that people were in awe of its existence, and were finding all kinds of uses for them. Someone even made a line of purses made of cut-up sections of billboard vinyl.

A Billboard Tip

To see how good a piece of billboard artwork is, stand so far back that you cannot even read the lettering (or if on a computer screen, reduce the image until it is probably only ½” wide). Then slowly increase the image size (or walk toward the artwork) to see the progression of what you can see and read as the sign becomes larger. Ideally, you would want a sign that grabs your attention through color alone at the farthest distance, and then allows your eyes to read the name of the business or product (such as McDonalds) followed by the exit information (the next most important item) followed by the tag line. The graphic should become slowly legible throughout the whole process. When you test art in this manner, it immediately identifies weak creative. If you cannot read the words until you are almost on top of the sign, then it’s a loser. Maybe the colors have no contrast, or the copy size is too small. Sometimes the graphic is too confusing for the consumer to understand the meaning. All these flaws can be found and corrected when you look at the artwork from far away.

The Market Report

Prices Are Delayed By At Least 15 Minutes